Summary

The Real-World Asset (RWA) sector is emerging as the next major breakthrough in crypto, outpacing other sectors in performance. By tokenizing assets like real estate, bonds, and stocks, RWAs are revolutionizing traditional finance, making investing more accessible, liquid, and efficient. Projects like $ONDO, $OM, $LINGO, and $LINK are leading this transformation, attracting institutional interest and regulatory advancements. With blockchain enabling secure and transparent asset ownership, RWAs are set to redefine finance. Don’t miss out on this game-changing trend!

Introduction

Crypto markets move fast, but one sector is standing out from the rest—Real-World Assets (RWA). Over the past month, while most sectors struggled, RWA remained the best-performing category. This is more than just a trend; it’s the future of finance. With projects like $ONDO, $OM, $LINGO, and $LINK leading the charge, the tokenization of real-world assets is becoming one of the hottest narratives in crypto.

🚨JUST IN: #RWA SECTOR REMAINS THE BEST PERFORMING CRYPTO SECTOR IN THE LAST 30 DAYS. pic.twitter.com/17SBX1tiI5

— Karan Singh Arora (@thisisksa) February 16, 2025

What is Real World Asset (RWA)?

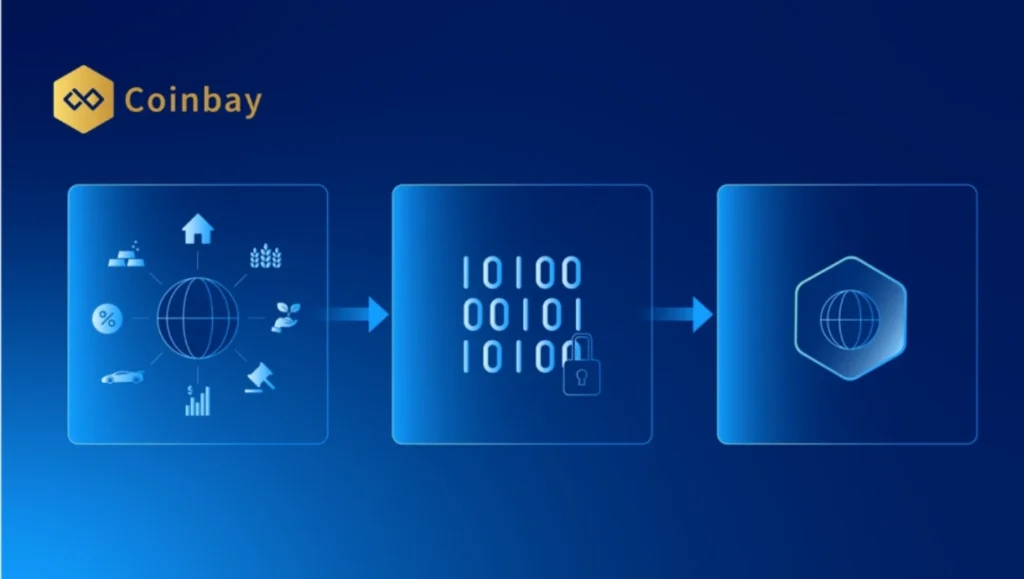

Think about it—real estate, bonds, stocks, and even commodities are being transformed into blockchain-based assets. This means you can own a fraction of a building or trade tokenized government bonds in a matter of seconds.

Why is this such a big deal? Because it makes investing more accessible, speeds up transactions, and removes unnecessary intermediaries. It’s like giving traditional finance a much-needed Web3 upgrade.

Why RWA is About to Explode?

Here’s why RWAs are getting all the attention:

#RWA tokens are the BIGGEST narrative this cycle.

— Real World Asset Watchlist (@RWAwatchlist_) February 15, 2025

A Trillion dollar market cap is coming in 2025!🚀 pic.twitter.com/nKkliAO6k5

- Big Institutions Are Watching – Traditional finance is moving toward asset tokenization to improve efficiency and security.

- More Liquidity, Less Hassle – You don’t need millions to invest in high-value assets anymore—fractional ownership is changing the game.

- Regulations Are Catching Up – Governments and financial regulators are starting to recognize and build policies around blockchain-based RWAs.

- New Ways to Earn – Yield opportunities with tokenized real-world assets are attracting investors looking for steady returns.

Top RWA Projects You Should Know About

1. Ondo Finance ($ONDO)

Ondo Finance is making waves by offering tokenized securities and stablecoin yield strategies. They’re bridging the gap between DeFi and TradFi, making investments more secure and scalable.

2. MANTRA ($OM)

MANTRA is a DeFi ecosystem that’s integrating RWA into staking and lending, giving users real exposure to asset-backed investments.

3. Lingo ($LINGO)

Lingo is all about democratizing access to real-world investments. By using blockchain, it makes asset transactions more transparent and secure.

4. Chainlink ($LINK)

Chainlink plays a crucial role in RWA by ensuring price feeds, ownership records, and transactions are reliable and tamper-proof. Without reliable data, tokenized assets wouldn’t be possible—making $LINK a key player in the space.

Final Thoughts: The Future of Finance is Tokenized

RWA is not just another crypto buzzword—it’s a fundamental shift in how assets are owned, traded, and managed. As institutional players enter the space and regulations evolve, this sector is only going to grow bigger. If you’re looking for the next big thing in blockchain, RWAs should be at the top of your list.

Stay Updated – Follow Blockpto.com