Cryptocurrency traders in India will face tax restrictions, including a new penalty of up to 70% on undisclosed crypto income. The move aims comply with tax laws and increase revenue from digital assets. If you have unreported crypto gains, here’s what you should know about the new tax amendment.

70% Penalty on Undisclosed Crypto Gains

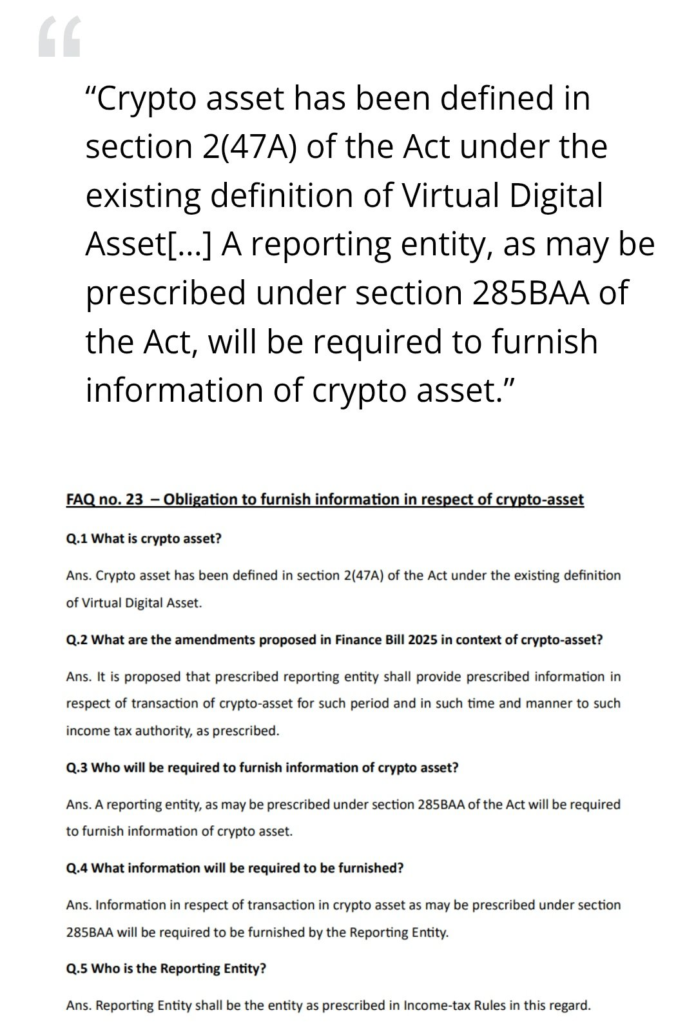

According to recent modifications, traders who fail to disclose cryptocurrency income for up to 48 months after the relevant tax assessment year may face an immense penalty. The penalty is calculated as 70% of the total tax and interest due on the additional income revealed in the revised income tax return (ITR). This adjustment reflects the Indian government’s strict position on cryptocurrency taxation.

Why This Amendment Matters

The tax amendment comes after the Bybit exchange’s announcement of its service suspension in India on January 10, due to regulatory challenges. As authorities strengthen their control over crypto trading platforms, investors and traders need to adjust to the evolving compliance environment.

Global Crypto Tax Trends

India is not alone in enforcing cryptocurrency taxes. In June 2024, the US Internal Revenue Service (IRS) issued new laws requiring third-party tax reporting for cryptocurrency transactions, which will go into force in 2025. These regulations led to concerns that traders would transfer to decentralized platforms to avoid tax inspection, complicating income tracking.

How Traders Can Stay Safe

Report Crypto Gains: Make sure to accurately report all your cryptocurrency earnings in your income tax return to stay clear of penalties.

Keep Detailed Records: Keep track of all transactions, including your buy and sell history, wallet addresses, and exchange statements.

Talk to a Tax Professional: Because crypto taxes can be complicated, getting expert advice can help you follow the rules easily.

Choose Trustworthy Exchanges: Trade on platforms that follow local rules to reduce risks linked to non-compliance.

Conclusion

With the imposition of a 70% tax penalty on undeclared cryptocurrency revenues, Indian traders must be extra cautious about tax compliance. As globally regulations tighten, remaining aware and proactive in reporting cryptocurrency revenue is critical for avoiding major penalties.

🚀 Stay tuned to blockpto.com for the latest updates on crypto, AI, and future tech innovations!

Frequently Asked Questions

What is the new crypto tax penalty in India?

The Indian government recently imposed a 70% penalty on undisclosed cryptocurrency profits. This penalty applies to gains that are not reported for up to 48 months after the relevant tax assessment year.

Who will be affected by the 70% crypto tax penalty?

In India, crypto traders and investors who haven’t reported their digital asset profits in their income tax returns will face this penalty.

How can I avoid paying the 70% penalty on my crypto gains?

To avoid penalties, disclose all cryptocurrency transactions on time, keep accurate financial records, and get advice from a tax specialist on compliance.

Does this tax amendment apply to all cryptocurrencies?

Yes, the penalty applies to the profits from all cryptocurrencies, including Bitcoin, Ethereum, and altcoins, that are not properly reported in tax returns.

What happens if I fail to disclose my crypto income within the given timeframe?

If undisclosed crypto income is discovered after the 48-month period, traders could face major financial penalties, legal consequences, or additional regulatory limitations.